Online Payday Loans in Texas

- Texas Payday Loans Online from Direct Lenders

- Almost Instant Approval

- Guaranteed Approval for Qualified Candidates

- Quick Cash Available

- No Credit / Bad Credit OK

- Fast and Secure Cash Loan Near Me

Payday Loans in Texas

Applying for an online payday loan from $100 to $1,500 can be the right solution for your short-term financial needs. With 1F Cash Advance, you get fast loan decisions for your payday loan. Our team ensures the confidentiality of your data while you apply for the payday loan you need.

How to Get Your Texas Payday Loans Online?

Anyone can easily apply for small payday loans online with 1F Cash Advance. Just follow the three simple steps:

- Submit your loan request. Fill in the information. No faxing is involved in the process, and you don’t need to look for stores open over the weekend.

- Get approval. Once your information is submitted, we share it with trusted direct lenders licensed and examined to operate in Texas. In case of a positive response, the lender will send you an offer via email.

- Receive your funds within one business day. Direct lenders understand that most of their clients need the money fast, sometimes in one hour.

That seems easy. The entire process is just as straightforward. Fill out your loan application now if you’re struggling with a financial emergency. Remember that an emergency cash advance can only meet short-term financial needs. It is no match for customers looking to meet long-term financial goals.

How to Qualify for an Online Loan in Texas

To be eligible for a payday loan in the state of Texas, you need to meet the required criteria:

- Be 18 or older and provide a valid ID to prove it;

- Have *a steady source of income. It’s advisable to have had a job for at least three months before applying for a loan. Moreover, some direct payday lenders also require you a minimum monthly wage of at least $1,000;

- Hold an active banking account;

- Provide accurate contact details (home address, phone number, email address);

- Hold US citizenship or have a permanent residence status.

Alternatives for Texas Payday Loans

If you don’t want to borrow payday loans in Texas, you may choose auto title loans. With this loan product, you may borrow some portion of your car’s cost but with one condition: your vehicle must be the collateral of your loan. The biggest advantage of these auto title loans is that you can get a higher loan amount and at a lower interest rate compared to a regular payday loan.

However, be careful. If you don’t manage to pay the full amount of your auto title loans, the lender might seize your vehicle. That is why we suggest you be a responsible borrower and make payments on time.

Terms and Rates for Texas Payday Loans

- Texas payday loans allow borrowers to take a payday loan for a minimum of 7 days and a maximum of 180 days.

- Since there are no specific interest rate caps, the APR can reach and exceed 400%.

- Your loan must not exceed 20% of your gross monthly income.

- You may have a maximum of three rollovers as long as you pay a minimum of 25% of the principal.

Examples

| Loan principal | Fee | Amount to repay | Term | APR |

|---|---|---|---|---|

| $300 | $25 | $375 | 14 days | 651.78% |

| $550 | $20 | $660 | 14 days | 521.4% |

| $1,000 | $15 | $1,150 | 14 days | 391.07% |

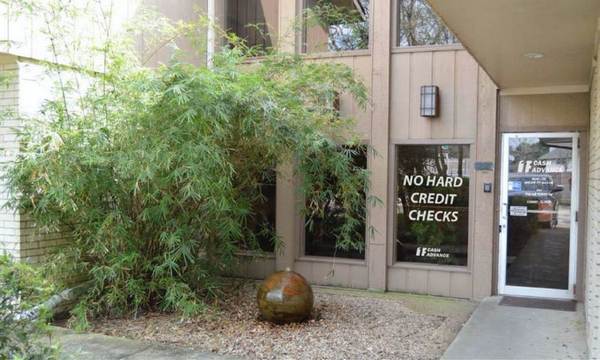

In-Store Payday Loans in Texas

Our branch manager will assist you with your loan application at our in-store location. For your convenience, we have enabled the possibility to make a payday loan request via email or by phone.

Cash Advance Products and Services

Payday Cash Advances

A cash advance allows you to apply today for fast cash and repay your loan from your next paycheck. Borrow as much as you need: $150, $200, $500, $650, $800, up to $1,000.

Installment Loans

An installment loan from direct lenders is another financial solution we have for you. Borrowing up to $5,000 is simple. You can repay such loans for up to 24 months.

Check Cashing

For customers who need quick cash, the majority of our in-store locations offer fast, quality service. Get your money in a matter of minutes at one of our locations.

Find a Payday Loans Store Near Me

At 1F Cash Advance, our main goal is to help people across the US reach their financial goals. We can help you get the loan you need as fast as possible, wherever you are. Not in Texas? No problem. Besides payday loans in Texas, we offer our products in California, Florida, Illinois, Missouri, New-Jersey, Ohio, Tennessee, Wisconsin, and Wyoming. We’re also happy to assist you online, so you can complete the application process in minutes from anywhere.

FAQ

Is 1F Cash Advance a licensed credit access business?

1F Cash Advance Financial Help, LLC is licensed by the Department of Financial Protection and Innovation.

Can I Get No Credit Check Payday Loans in Texas?

The reason is that most direct lenders operate on a no credit check basis. That means online direct lenders in Texas don’t typically pull a full credit check on you. Regardless of your credit history, you can still receive a loan offer.

How do I apply for a cash advance in Texas?

You can either submit an online loan request via our website or visit one of our locations. Borrowers find applying online more convenient.

How fast will I receive my funds if I get approved?

A direct lender will usually make a direct deposit into your bank account within one business day after signing the loan agreement. Online same-day deposits also happen occasionally, but they are not guaranteed.

Can I get a same-day loan?

It is possible to get a same-day loan, but it doesn't happen all the time. To increase your chances, try applying early in the morning on workdays.

What is the best online payday loan I can get in Texas?

Submit your request through 1F Cash Advance for an easy process and almost instant approval.

What if I have difficulties paying the debt on time?

Texas state laws allow for rollovers. However, payment of additional charges may be required. For any questions related to repaying your debt, please contact your lender.

Can I apply for a Texas payday loan if I don't live in Texas?

Both offline and online payday loans in Texas are available to residents only. The license of a payday lender is bound to the state that allows them to do business. Therefore, you will need to apply in your state of residence.

What if I don't get approved for an online payday loan in Texas?

That may happen. Despite potential advertising, no denial payday loans are a myth. Legitimate lenders will not take the risk if they don't think you can repay your loan. You can consider alternative options, such as secured loans, an auto title loan, or check the latest apps for loans.

Is it possible to get a no credit check payday loan in Texas?

Even if a lender advertises no credit check loans, you need to know that they will still perform soft pulls to check your creditworthiness. Also these inquiries don’t affect your credit score, loan providers make them to make sure you meet their requirements. But don’t worry. Your credit score is not a determining factor.

How many payday loans in Texas can I have at once?

State laws don’t specify how many payday loans in Texas you may have at once. As long as your income is enough to repay the funds on time, you can qualify. However, short-term loans may be difficult to handle, so it’s recommended to have only one payday loan at a time.