Cash Advance Loans Online

1F Cash Advance Can Help You Get Money Fast!

- Receive an Instant Decision

- Same-Day Funding Options

- Easy Online Application Process

- Good Credit Not Needed

Advertiser Disclaimer

1F Cash Advance is a financial platform that doesn’t offer loans. We connect you to potential lenders but don’t promise you'll get approved for a loan. The terms, rates, and fees may be discussed with the lender you were approved with. We recommend getting advice from a financial expert about dealing with money struggles without risky loans. For more information, read our full Legal Disclaimer.

What is a Cash Advance Loan?

A cash advance loan is a short-term, high-interest payday advance. People usually use it to cover unforeseen expenses, such as medical bills or car repairs. These loans are due in 2 to 4 weeks, with a pay date being tied to your next paycheck.

Cash Advance Rates and Fees

- Loan amount: $300.

- Repayment period: 14 days.

- Finance charge: $45 (including a $3 verification fee).

- Annual percentage rate: 391.07%.

- Total loan cost: $345.

Please note that cash advance loans are subject to approval. The example provided is for informational purposes only. The terms you get may vary depending on the lender and your credit score.

In-Store vs. Online Cash Advance

You can get a cash advance in two ways: in a store or online. An in-store cash advance is a suitable option if you need money the same day and have a physical branch in your area. Check out the list of our locations and choose a store near you to apply and receive the money. An online cash advance provides more flexibility, eliminating the need of visiting a branch. You’re welcome to apply on the website 24/7 and receive the funds via a direct deposit into your bank account. The process will only take one business day.

How to get a Cash Advance Online?

Applying through 1F Cash Advance is a streamlined process. Here are the steps to follow:

-

Quick Application

Fill out our application form online or in a nearby store.

-

Fast Approval

Get a loan decision via email in a matter of minutes.

-

Get Money

If approved, accept a loan offer and receive your funds via direct deposit to your bank account on the next business day.

Am I Eligible for a Cash Advance Loan?

To qualify for a cash advance loan from 1F Cash Advance, you commonly need to meet the following eligibility criteria:

- Be at least 18 years old;

- Have a valid government-issued ID card;

- Have an active bank or checking account;

- Specify a contact phone number;

- Provide proof of a stable source of income.

Online Cash Advance Alternatives

Payday Loans

A payday loan is a small, short-term loan with a high interest rate. You may get up to $500 or $1,000, depending on your state. Such loans are due on a borrower’s next paycheck, so loan terms are only 14 or 30 days.

What Are Alternative Options to Consider?

Cash advance loans come with steep interest rates and limited repayment periods. This may lead to loan defaults and high late fees that increase your total loan cost and affect your credit. Before obtaining one, consider several alternative options with more reasonable terms:

- Borrowing from family or friends. You may get an interest-free solution with the terms adjusted to your particular situation;

- Savings. If you have an emergency fund to turn to, aim for solving a problem without taking on extra debt;

- Credit cards. A credit card with a lower APR can help you save money on interest. If you have one, consider putting your emergency on its balance.

Why 1F Cash Advance?

1F Cash Advance was founded in 2019. Since then, we have grown and improved our products and services. Find out more about us and discover our core pillars.

- Quick approval process. You will get a response in as little as one hour.

- No hard credit checks. We accept borrowers with fair, bad, and poor credit, helping them get money fast without affecting their scores.

- Personalized customer service. Your needs are our main priority. Our team is here 24/7 to help you navigate the process.

- Direct deposit in 24 hours. If an emergency happens, you can get the money fast without letting the situation get worse.

- Safe & secure. We use SSL encryption to ensure your safe borrowing experience.

- Transparent loan terms. No unpleasant surprises hidden under the fine print.

FAQs

How Can I Contact Your Customer Service?

We are at your disposal in the working hours. Contact us at (720) 428-2247 or via email: [email protected].

Is an Online Cash Advance Safe to Use?

Many trustworthy lending companies offer cash advances. However, you may find predatory lenders. You are advised to ensure the license of the loan provider complies with the US lending laws.

What Are Potential Risks of Cash Advance Loans?

The main risks of a cash advance loan are its high interest rates and fees and short repayment terms. These factors make them difficult to manage, often leading to debt traps. Thus, you may find yourself taking out another loan to cover the previous one.

If you default on your cash advance loan, a lender may charge you late fees, while a bank will apply not-sufficient funds fees. These costs may add up quickly, making your loan several times more expensive. The unpaid debt also drops your credit score and stays in your credit report for seven years, affecting your overall financial life.

Finally, loan delinquency can potentially lead to collection calls, litigation, and paycheck garnishment. Before obtaining a cash advance loan, make sure you get reasonable terms and have a clear repayment plan.

Do I Understand Cash Advance Rates and Terms?

Our partners clearly outline cash advance rates and terms in a loan agreement. Read it carefully and contact your lender if any questions arise. Make sure you understand the conditions and are fine with them before accepting an offer.

Can I Afford My Loan Payments?

The amount you need to repay to a lender will be specified in your loan contract, along with the repayment schedule. Be realistic about your ability to make your monthly payment and ensure the sum suits your budget. If you can’t afford your loan payments, consider alternative options.

Discover Our Payday Loan App

Apply from your smartphone with just several taps. Check our payday cash advance app available for iOS and Android.

Download the 1F Cash Advance App:

Get a Loan Fast!

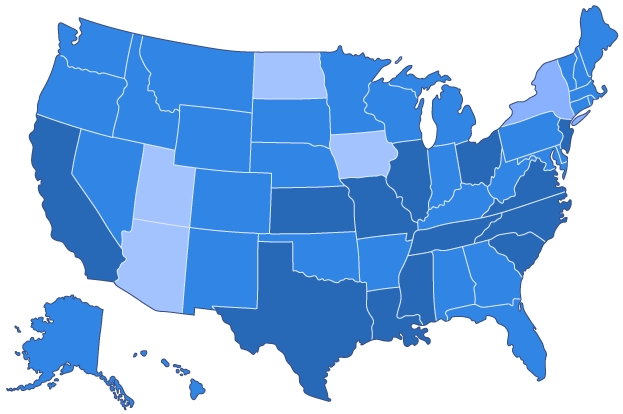

Get a cash advance when you need it by visiting our stores in almost all US states. If you don’t want to stay in line, just access the application form online!