Cash Advance Loans Online

Get money today with no credit check. Your financial journey starts here!

- Quick & easy application

- Instant approval decision

- Same-day funding options

- Loans from a cash advance lender

Pick Your Perfect Loan Option

Cash Advances

Also known as a payday loan, payday advance, small dollar loan, a cash advance is a short-term loan that needs to be repaid by your next paycheck. It provides 24/7 financing for small emergencies like car repairs or utility bills.

Explore Now

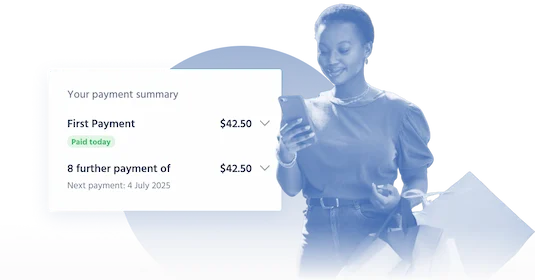

Installment Loans

An installment loan offers a flexible solution for larger expenses and long-term needs, such as home improvements and medical costs. Make your debt more manageable by repaying in small, fixed installments over up to 24 months.

Explore Now

Same-Day Loans

Same-day loans can help you meet your urgent needs that can’t wait till tomorrow. Our fast cash loans allow you to receive the money you need as soon as today and get back to your day quickly.

Explore Now

3M+

loans issued

80+

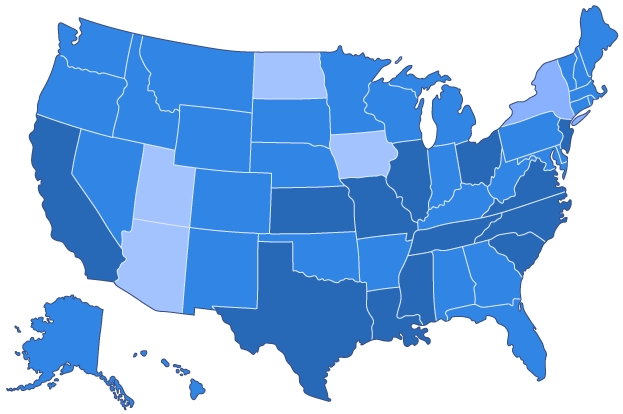

locations in 37 states

6

years of trust

Why Choose 1F Cash Advance

At 1F Cash Advance, we know that emergencies happen. That’s why we make it easier for borrowers with any credit to access fast financial help when they need it most. We’re proud to be the loan company people turn to when they’re looking for a licensed loan provider offering fair financial solutions and exceptional customer service.

A smart loan process

We look at more than just your credit score so you have a fair chance to get the loan you deserve no matter your FICO rating.

No hidden fees

Our upfront terms ensure all the fees are clearly outlined in your loan agreement so you’ll always know exactly what to expect.

Affordable payments

Competitive interest rates and flexible repayment options make it easy to find a solution that fits your budget.

Get Your Money in 3 Simple Steps

Here’s how to get a cash advance loan online or at a store:

Apply in minutes

Complete an online application form or visit a 1F Cash Advance physical location near you.

Apply NowGet an instant decision

No hard credit check is involved, so you will receive a response within minutes of submitting your loan request.

Receive approved funds

Finalize your loan by 10:30 am on weekdays and get the money on the same day*

*Loans approved after 10:30 am or on weekends will be funded in the morning of the next business day.

Get an Online Cash Advance in Minutes

- Receive an instant decision

- Follow a hassle-free process

- Get your cash immediately

FAQs

What is a cash advance?

A cash advance refers to a small loan of up to $1,000 you can get through a credit card, money app, direct lender, or your employer. It typically needs to be repaid in 2 to 4 weeks and may come with high APRs and fees.

How much can I borrow with 1F Cash Advance?

We offer small cash advance loans between $100 and $1,000. If you need a larger amount for a longer period, consider our unsecured installment loans of up to $5,000.

How fast can I get the funds?

On average, approved borrowers receive the money within 1 business day. Instant cash loan options are available to in-store applicants who repay via a post-dated check.

Is there a loan application fee?

We don't charge any application fees for our payday loans or installment loans. There are no upfront costs when you borrow with us.

How much does a small cash advance cost?

Our loan terms vary by state. Payday loans carry a maximum APR of 600%, while installment loan interest rates can reach 490%. Your specific APR will be determined based on your credit profile.

Can I receive my cash advance loan on the same day?

The approved amount is typically transferred via a direct deposit within 24 hours. Loans accepted before 10:30 am local time on weekdays can reach your bank account on the same day. Otherwise, you will receive the funds on the next business day.

Will the application affect my credit score?

Applying via 1F Cash Advance doesn’t affect your FICO rating. The verification process only involves a soft credit check, which isn't shown on your credit report. Your credit score may only be affected if you default on your loan.

What if I have bad credit?

Your credit score is not the only factor that affects our decision. We prioritize your income and payment history. Therefore, bad credit borrowers can still qualify for a quick cash loan with us.

What can I use the money for?

1F Cash Advance loans can help you meet a wide range of your urgent needs, such as hospital and utility bills, car emergencies, and other unexpected expenses. There are no restrictions on a loan purpose.

Is it safe to apply for a cash advance loan?

With 1F Cash Advance, you can rest assured the entire process is safe. We use the latest security software and encryption technologies to protect your personal and financial information. The padlock icon in the URL address bar shows that the website is safe to use.

How can I contact Customer Support?

You can reach out to our Customer Support team by phone or email. Call us at (720) 428-2247 or let us know how we can help you by writing to us at [email protected]. Our professional staff will guide you every step of the way and answer all your questions.

View Loans Available in Your State

Get Cash Your Way – In-Store or Online!

Get an online cash advance loan via the website or visit our nearest store for a personalized borrowing experience. Our locations are available in many US states.