Online Payday Loans in Arizona

- Get money nationwide

- Legitimate direct lenders

- Borrow from $100 to $5,000

- Small online loans in AZ

- Installment loans & cash advances

- Same and next business day funding

Why Trust Us?

1F Cash Advance has been providing emergency loans since 2019. We are licensed and operate under state laws. Over 140,305 consumers have already benefited from our services, both online and in stores.

Fact-Checked

Each our article is reviewed by leading industry experts and updated regularly. We ensure accuracy and currency through daily audits and automated updates. Learn more about our editorial standards.

Arizona residents looking for short-term loans can rely on borrowing options offered by 1F Cash Advance. We are a local service that provides a quick fix in emergency situations for all credit types. We offer no credit check payday loan alternatives that fully comply with the state laws. Our small loans are available online and in a store and can be deposited into your account even on the same day.

What Are Payday Loans and How They Work?

Payday loans are short-term emergency loans borrowers obtain to solve unexpected financial issues. These loans are primarily popular with bad credit customers in urgent need of money due to their convenient online application, fast processing times, and lenient requirements. The amount you can get ranges by lender and state and is usually $50 to $1,000. The repayment is made in one lump sum in 2 to 4 weeks, typically by a borrower’s next paycheck.

Although payday loans are fast and easy to get, they are also difficult to handle. Their short repayment terms, followed by APRs of over 400%, often trap borrowers in a cycle of debt. Therefore, the usual payday loans are prohibited in Arizona, and APR caps are applied to protect borrowers from financial risks.

Our Products and Services

Cash Advance Loans

Cash advance loans are short-term loans that can be used for unexpected expenses. Get between $100 and $1,000 within 24 hours without any collateral, long lines, and extensive paperwork. Apply online via our platform or visit one of our in-store locations.

Installment Loans

If you think of a more significant purchase, apply for an installment loan through 1F Cash Advance. Installment loans offer larger amounts between $500 and $5,000 and can be repaid in fixed monthly payments within 2 to 24 months.

In-Store Check Cashing

We’ve added a check cashing service to most of our stores. It’s a convenient way to get your money quickly and easily. See if our service is available in your area and use it whenever you need it.

How to Apply for a Small Loan Online?

The application process through 1F Cash Advance is straightforward and only takes a few minutes. Follow the steps below to submit a loan request.

-

Fill out and submit the application form. Provide your basic personal and financial details via our secure online form. It's usually a 5-minute deal.

-

Get an approval decision. You will receive an email within 15 minutes to 1 hour. If you qualify, read the loan agreement carefully and and e-sign it if you accept the terms;

-

Get your funds. A direct deposit typically reaches a borrower's checking account as soon as the next business day.

The repayment is usually made via automatic withdrawal from your bank account on the due date. Repaying your debt on time is crucial. Failing to fulfill your obligations may result in additional fees and penalties and impact your credit score, making it difficult to get approved for a loan in the future.

Loan Requirements for Arizona Residents

Anyone meeting the conditions listed below can qualify for a loan through 1F Cash Advance.

- Age: You must be 18 or older to apply;

- Citizenship: Being an American citizen and a permanent Arizona resident;

- Banking details: You need to have an active bank account in your name;

- Employment: Lenders usually require you to have a steady job.

- Income: A minimum of $1,000 per month is usually required.

- Contact details: A valid email address and active phone number.

- Documents: Bring your ID or driver’s license, Social Security number, proof of income and employment, and proof of address.

Rates and Fees for Arizona Loans

Arizona has strict lending rules designed to protect borrowers from expensive payday loans and predatory lending practices. Loan providers that operate in the state have to comply with a 36% APR cap for all consumer loans below $3,000. As a licensed company in AZ, 1F Cash Advance follows fair lending protocols and the rules and regulations set by local authorities.

Representative Example

| Loan Principal | Total Interest | Total Amount to Repay | Term (months) | APR |

|---|---|---|---|---|

| $500 | $15 | $515 | 1 | 36% |

| $1,000 | $107.5 | $1,107.5 | 6 | 36% |

| $3,000 | $616.64 | $3,616.64 | 12 | 36% |

Please note that the offer you get from a lender may vary. The table above provides examples for informational purposes only. Your exact APR will be determined based on your credit. If you choose another repayment period, the cost of your loan will also change.

Benefits of Small Loans

Among their most apparent benefits, small loans offered by 1F Cash Advance have the following advantages:

- Simple application process;

- Flexible terms and amounts;

- Lenient requirements;

- Quick deposit;

- No hard credit checks.

Why You May Need an Online Loan

Online loans are helpful when you are dealing with unexpected expenses and need a small amount fast. If other financial institutions have rejected your loan application or need more time to process your details, loans offered by 1F Cash Advance can make the difference. Arizona residents typically get them for one of the reasons below:

Pay for rent, utility, buy groceries or handle minor daily expenses that require a couple of hundreds of dollars until your next paycheck.

Do minor house repair works. When you have a leaking pipe or you need to replace essential house appliances, a small loan may be the right choice.

Finance car repair. If you rely on your vehicle to earn money or pick up family members from school or work, we can help you get your car back on the road.

Repair damages caused by natural disasters until you get your insurance funds.

Cover medical bills. Whether you or your family members need urgent medical treatment, small loans can help you pay for these costs quickly.

Responsible Borrowing Practices

Although small loans can provide a lifeline in case of urgent money needs, you need to treat them responsibly to avoid negative financial and credit consequences. Here are key principles for your smooth borrowing experience:

- Make sure you really need a loan. Borrow money only for a good reason and avoid overspending;

- Consider alternatives. Check out whether there are cheaper offers or options that don’t require going into debt, such as savings or selling unnecessary stuff;

- Determine the right loan amount. Don’t borrow more than you can afford to repay comfortably;

- Have a solid repayment plan. Make sure you know how you will repay the amount borrowed. Late payments may result in extra fees and credit score damage;

- Shop around. Compare several lenders and the terms they offer to find the best possible option. Read customer reviews before entering any deals;

- Choose a lender carefully. Avoid loan providers that don’t check your overall credit and financial situation as they typically don’t care how you will repay the money.

- Double-check your loan agreement. Read any loan documents carefully before signing them and make sure you understand the terms.

Alternatives to Payday Loans in Arizona

Arizona residents can consider one of the following alternatives to regular payday loans:

- Payday alternative loans. PALs are offered by credit unions in order to help their members avoid high-interest debts. They come with longer repayment terms, higher amounts, and much lower APRs.

- Installment loans. These are flexible financial solutions available to borrowers with any credit. They allow you to get up to $5,000 and repay the funds in affordable monthly installments within up to 24 months.

- Personal loans. A personal loan is an up to $50,000 financing with the repayment term of up to 60 months. It’s suitable for long-term financial goals. A high credit score may be required, particularly for unsecured loan products.

- Car title loans. Borrowing money against the title of a vehicle allows you to get the money and use the car simultaneously. Still, the option has short repayment terms, which may result in collateral loss.

- Lines of credit. A line of credit will offer you the flexibility of borrowing as you need, up to a predetermined limit. Be aware that interest rates on this type of loan make a change along the way.

- Cash advances from your employer. Many employers offer interest-free cash advances that will be deducted from your next paycheck.

- Family loans. Consider taking out a loan from family members or friends to get money at low or no interest and with flexible repayment terms. Set clear arrangements to avoid any misunderstanding.

We Offer Online Loans in These Arizona Cities

Apply for a loan via our platform or visit our branch to get the best offer from top legitimate lenders. 1F Cash Advance offers its services to residents of Phoenix, Tucson, Mesa, Chandler, Gilbert, Glendale, Scottsdale, Peoria, Tempe, Surprise, Goodyear, Buckeye, San Tan Valley, Yuma, Avondale, and other Arizona cities.

Why Choose 1F Cash Advance Services?

When you apply for a loan through 1F Cash Advance, you prioritize safety and the quality of the services received. Arizona residents choose us because of one or a combination of the reasons below:

- Straightforward application process. We only ask for information needed to make a loan decision; the procedure is optimized to the customers’ benefit.

- Direct licensed lenders. Our network of professionals includes top industry leaders with extensive experience in lending.

- Fair terms. Since we work with lenders within a competitive industry, each strives to exceed the customers’ expectations by improving their services. In effect, you get better deals.

- Quick approval.It typically takes us a few minutes to assess your eligibility and provide an offer if you qualify.

- Fast deposit. The money is usually transferred to your bank account right after you sign an agreement. Thus, most borrowers get their funds within 24 hours.

- Automatic repayment.As the money will be automatically debited from your bank account on the due date, you don’t risk forgetting about your debt and dealing with penalties. Just make sure you have sufficient funds in your account on the maturity date.

- Data security. When you apply with us, your data is protected at no charge. We do not share your information with any unaffiliated third parties.

- Transparency. No hidden fees, no extra charges. We have a zero-tolerance policy for misleading information and unfair conditions.

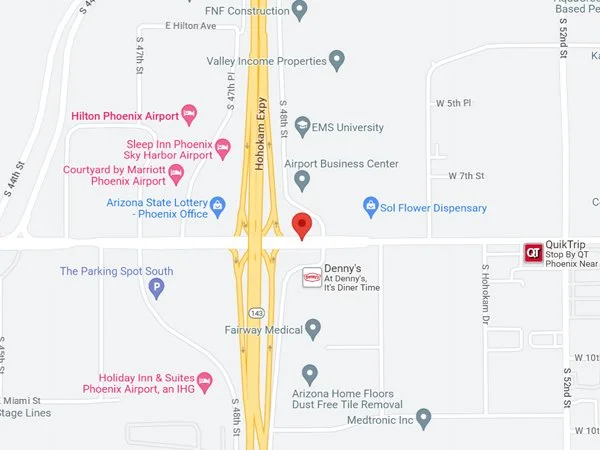

Visit 1F Cash Advance Store in Arizona

Branch name: 1F Cash Advance Arizona

Address: 2604 W University Dr, Mesa, AZ 85213

Phone: (888) 847-2909

Email: [email protected]

Branch Manager: Tiller Martin

Hours:

Monday – Friday: 8:00 am to 10:00 pm

Saturday: 9:00 am to 6:00 pm

Sunday: Closed

Small Loan Near Me

We have multiple physical stores throughout the country and are always here to offer fast and accessible solutions to those who need them. Visit us in our payday loan stores in Wyoming, Connecticut, Ohio, Tennessee, Georgia, Hawaii and get qualified assistance in a matter of minutes. Choose your state and check out the list of locations available to find the nearest one to you.

Frequently Asked Questions

Are payday loans legal in AZ?

The State of Arizona prohibits all small loan products with APRs that exceed 36%. 1F Cash Advance offers legitimate small loans that comply with the official state regulations.

Is 1F Cash Advance licensed?

1F Cash Advance is a licensed service that works under federal law and complies with local state regulations in each state it operates.

How much money can I borrow?

At 1F Cash Advance, you can get between $100 and $5,000, depending on your income and loan type.

How long does it take to get approved and receive my loan funds?

At 1F Cash Advance, you can get a loan decision within 15 minutes to 1 hour. Approved borrowers usually receive the funds as soon as the next business day or on the same day (for applications approved before 10:30 AM on weekdays).

Do you perform a credit check?

Loans offered via 1F Cash Advance typically come with a soft credit check. Such a check is safe for your credit score as long as you pay on time. Still, we review your credit and financial situation to make sure you can comfortably repay the requested amount.

How much does a small loan cost?

Lenders that legally operate in Arizona are prohibited from charging more than 36% APR on consumer loans below $3,000. The exact APR will be determined by a particular lender based on your credit score, payment history, and income.