1F Cash Advance App – Best App For Instant Cash

Do you need quick extra cash for an emergency? Are you looking for a payday loan that is fast, safe, and easy to get? Then, 1F Cash Advance App is the best app for instant cash. With our cash advance apps, you can borrow up to $250 as soon as today.

Over 50K Americans have downloaded our cash advance apps, and our lending partners have made over $5 million in loans since the app launch. We pride ourselves on ensuring that every customer is satisfied with our banking services provided.

What is a Cash Advance App?

A cash advance app is a simple way to get the money you need to make it through the week. With just a few taps, you can easily apply for cash advances and get instant approval. The cash advances will appear in your checking account as soon as the next business day, so you won’t have to worry about being late on bills or missing out on necessary expenses.

Paycheck advance apps are also great because they don’t require a hard credit check or complicated paperwork. You can apply now and get approved within minutes for all types of cash advances, regardless of your credit history.

1F Cash Advance App: Get Cash Instantly

Do you have a short-term financial emergency that requires an immediate influx of funds? If so, it might be time to take out a small payday loan online. Traditional payday loans are small, short-term loans that can cover unexpected expenses or help pay off existing debts until your next paycheck.

With our app for cash advances, you can quickly get the money you need—all from the convenience of your phone! Just imagine: you can get up to $250 instantly via your smartphone or tablet! No waiting around at the bank or going through an application process: just download our app from Google Play Market or App Store and complete our simple application process in as little as five minutes. It’s fast, easy, and convenient.

How Does 1F Cash Advance App Work?

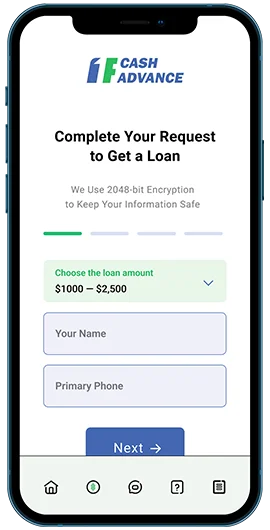

Cash advance apps like those offered by 1F Cash Advance are an easy and convenient way to get a cash loan now. We're here to help you get the cash you need as soon as possible. All cash advance apps work exceptionally efficiently, and our app for instant money is no exception. All you have to do is:

-

Download the app from the Apple App Store or Google Play Store.

-

Fill out an application with basic info (name, email address, phone number).

-

Get an approval decision within several minutes.

-

If approved, your lender will transfer the money to your checking account within one business day.

-

On the due date (or next paycheck), the lender will withdraw the loan amount and its costs from your checking account.

Pros and Cons of Loan Apps

Each money-borrowing app has its pros and cons. Knowing them will help you understand whether this type of borrowing will suit you.

Pros:

- Data security. Reputable apps use the latest technology to protect your data. Our app that uses the same encryption technology banks use to keep your money safe and secure;

- No paperwork. Cash apps make it simple and easy to get the money instantly without filling out any paperwork. All the supporting documents can be provided electronically;

- Hassle-free process. You can be approved to get money from the comfort of your home by following a few simple steps;

- Bad credit is accepted. Even if you have some negative records in your credit report, a loan app can provide you with money fast. There are no hard credit checks performed;

- Wide network of trusted direct lenders. We partner with a vast network of trusted direct lenders to help you get a cash advance online without involving any middlemen.

- Almost instant approval decisions. You’ll get an answer from a lender almost instantly, typically within 5-15 minutes.

- Direct deposit within one business day. Approved borrowers can access the funds within 24 business hours, often on the same day they apply.

Cons:

- Limited loan amounts. Typically, a borrower can get up to $500 or $250, making loan apps inappropriate for some major purchases;

- Short repayment terms. As the funds must be repaid within just a few weeks, loan from money borrow apps can’t be used as a long-term financial solution;

- Potentially high costs. When you borrow money from a cash advance app, it’s often more expensive compared to traditional loans. It’s especially true if you have bad credit.

Why Should I Use 1F Cash Advance App?

Payday loan apps are a fast and easy way to borrow money from your bank account when you need it most, without paying high-interest rates. We can help you with your car repairs, unexpected medical bills, or even getting caught without enough cash for groceries on the weekend. Our service is available anywhere in the U.S., and there are no overdraft fees (hidden fees) or hard credit checks for the credit score—just fast cash!

Our app is available on Android and iOS devices, so you can get your money when needed. You don’t even have to leave your home to apply! Just download the app now and see if it’s right for you!

Basic Requirements for Getting Cash Advances via 1F Cash Advance App

To be approved through our app, you should meet the following eligibility criteria:

- Be at least 18 years old;

- Be a US citizen or permanent resident;

- Have a steady monthly income (at least $1,000 per month);

- Have a valid bank account, Social Security Number, phone number, and email address.

Tips for Using Cash Advance Apps Wisely

The best cash advance apps can be a lifesaver when you’re short on funds and need fast cash. But they can also be a trap if you don’t use them responsibly. Here’s how to use loan apps wisely:

- Don’t fall into the trap of thinking that these loan apps are free money—they aren’t! They charge interest rates that are often too high for what they give you. Be careful about how much you borrow and how much it costs you in interest payments over time.

- Know your credit score before applying so that you know how likely it is that you’ll get approved for a loan on those terms (and, therefore, how much money the loan will cost, in case you have a bad credit score).

- Make sure that any cash advances or lines of credit are paid off well before the due date to avoid getting caught in an endless cycle of debt payments!

Alternatives to Instant Cash Advance App

When you need a cash advance, what do you do? You probably go to the nearest store that offers payday loans. But are these options the best for your situation?

Let’s explore some alternatives to getting instant cash advances from cash advance apps (no credit check):

Small Personal Loans

Small personal loans can be a great alternative to payday loans from most cash advance apps. These personal loans are more flexible and have lower interest rates, making them less expensive in the long run. Plus, many small-dollar loans offer automatic payment plans that make it easier for you to stick with your payments each month.

Credit Union Loans

Credit unions offer great deals for their members. As these institutions are nonprofit and member-owned organizations, their loan options are typically cheaper than other personal loans. Therefore, you can get a small loan at an APR of 18% to 27%. Although credit unions make hard credit checks, you can still qualify with bad credit. This is because your membership plays an important role at a decision-making stage.

Borrow from Friends and Family

A family loan is when one member of your family lends money to another member without charging interest or overdraft fees. It can be challenging for people who live far apart from each other to track how much they owe each other. If you choose this option, make sure both parties avoid misunderstandings later on about the debts.

“Buy Now, Pay Later” Loans

These loans are usually available when you shop online. By using them, you can order and get the needed item right away and pay off its cost in a series of monthly installments. The first payment is due at the moment of purchase. These loans typically come with soft credit checks and can be available with bad credit.

Fees of Payday Advance App

As with any loan, overdraft fees and other fees vary from one lender to another. Therefore, it’s essential to shop around before choosing a lender.

Each personal loan contract may come with a different annual percentage interest rate. Other cash advance apps for instant money, like 1F Cash Advance, can’t tell you the contract details as it’s not their competence. To be entirely informed, check the following list of fees you may be charged:

Monthly Membership Fees

A monthly subscription fee is a fee you pay for using the app function. It usually ranges from $5-$30 per month, with the most common price being around $15. However, our app doesn’t charge any additional fees.

Same-Day Funding Fees

A same-day funding fee is a fee you pay to your instant cash advance app to get your money by the end of the same day you applied. It’s a percentage of the borrowing limit, typically between 15% and 25%.

External Bank Account Fees

A bank account fee is charged if you use an outside bank account or a savings account to receive your cash advances. It is typically a flat fee for an external account that can range from $10-$40 per transaction.

Late Payment Fees

Late payment fees are a percentage of the total amount owed on your loans that you must pay in addition to the cash advance amount borrowed. These late fees are charged only if you are late on payments after the due date.

Start Your Application Now. It Only Takes Minutes

Don’t wait for your problems to grow! Instead, submit the loan application form now. It only takes minutes to complete the entire thing, and you can submit it from any device with an internet connection.

Once you’re done filling it out, we will send it to our lenders, and they’ll process your application and get back to you within several minutes. If you have any questions along the way, don’t hesitate to reach out to our support team. We are ready to help you 24/7!

FAQs

Does Borrowing Money With 1F Payday Loan App Affect My Credit Score?

Borrowing money with our cash advance apps via minimum monthly direct deposits won't affect your credit score because our direct lenders perform only a soft credit check that doesn’t require detailed credit monitoring.

How Much Money Can I Borrow?

Depending on the app, you can borrow between $50 and $1,000 via a direct deposit.

Are Cash Advance Apps Payday Lenders?

Cash advance apps are not payday lenders. Instead, the best cash advance apps just help you find the right lender that will help you cover expenses within one business day.

What Happens If I Can’t Repay a Loan from Cash Advance Apps?

If you can't repay a cash advance, the lender will try to collect the debt by contacting you. If you don't respond or make any payments, they may take legal action against you, including suing you for the amount owed.

How Much Does a Cash Advance from an App Cost?

You can get a cash advance from an app for as little as $15. You'll pay between $10 and $30 for every $100 borrowed, depending on how much you need and the pay period.