Get $50–$1,000 with 1F Cash Advance App

Cash when life happens. Not when banks decide.

When Your Wallet Needs Backup

Car repair you weren't expecting

Gas to get to work

Groceries before payday

That surprise medical bill

Phone overage you forgot about

Why Use Our Instant Cash Advance App

You work hard for your money. Getting some early shouldn’t be complicated. We streamlined the whole process.

-

No Credit Check

We look at your income today, not your past mistakes. Bad credit won’t stop you from getting approved.

-

No Hidden Fees

The amount we show is what you pay. No surprises, no fine print tricks, no last-minute charges.

-

Instant Decision

Apply online in 5 minutes. Get your answer right away. Money hits your account as soon as today*.

-

Real Money Range

Start at $50 when others offer $20. Qualify for up to $1,000 while other apps cap at $250.

Fast Cash Advance App

Skip the account setup. Skip the verification emails. Just fill out a short, easy form and get your approval decision within minutes. Borrow money almost instantly. Emergencies don’t wait.

More Money When You Need It

Other cash advance apps limit you to pocket change. We offer real amounts that actually help. Whether you need $100 for food or $1,000 for rent, we provide meaningful financial support when traditional lenders say no.

Smart Debt Tracker

Never miss another payment date. Track every loan, every payment, every dollar saved on interest. Get a complete visual view of what you owe. Know the exact day you’ll become debt-free.

How to Get Your Advance Now

Get Approved

Guaranteed approval decision based on your current income.

Receive Funds

Money is deposited directly into your bank account on the same day*.

FAQ

What is a cash advance app from 1F Cash Advance?

It's a short-term cash boost before your payday. Borrow what you need and repay on your next check. Our new cash advance app gives fast decisions and provides clear terms with no hidden fees.

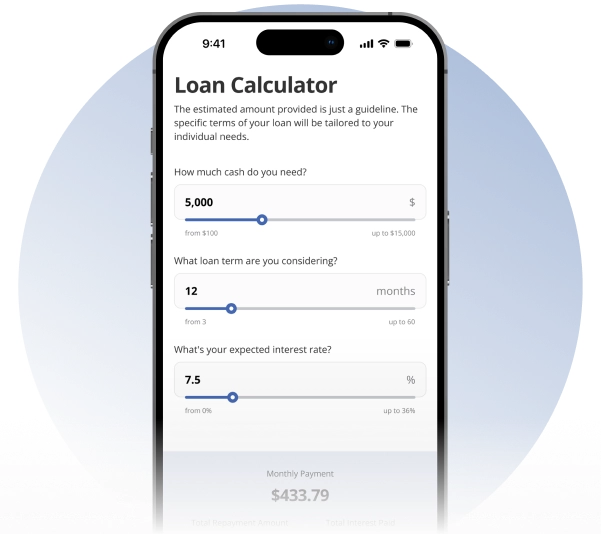

What alternatives do you offer?

We also offer payday loans up to $1,000 and installment loans up to $5,000. Payday loans are best for urgent, one-time bills or emergencies. Installment loans spread payments over 2 to 24 months, equally.

Is the 1F Cash Advance app safe?

Yes. Our cash advance app requires no credit check and uses military-grade protection with secure bank linking. Your data stays protected from start to finish. We follow federal and state rules for online lending.

How long do I have to pay back a cash advance?

We provide short-term advances that must be repaid on your next payday. That usually falls within 14 to 31 days. You will see the exact date before you accept the loan agreement.

How fast can I get my money?

*Most approved applications receive funds on the same business day if applied before 10:30 am local time on weekdays. Evening or weekend approvals post the next business day. Exact timing also depends on your bank.