Emergency Cash for Single Mothers

13 Min Read

- Key takeaways

- Why emergency cash matters for single mothers today

- Government programs that cover emergencies

- Where to find emergency grants for single mothers

- How to raise emergency funds through crowdfunding

- Local nonprofits and charities offering emergency aid

- Extra ways to get money now without a Loan

- Fast emergency loans for single moms with bad credit

- Be mindful if you decided to get a loan

- What to avoid: predatory lenders & scams

- FAQ

Key Takeaways

- Single mothers face high poverty rates and urgent expenses like rent, childcare, and medical bills, making quick financial help critical.

- Government programs (TANF, SNAP, WIC, LIHEAP) and grants (Modest Needs, CORE, Kickass Single Mom) provide emergency aid without debt.

- Local charities (United Way, Salvation Army, Catholic Charities) and crowdfunding can deliver fast, practical support.

- When all else fails, short-term loans are available, but borrowers must read terms carefully and avoid predatory lenders.

Raising a child is not easy but it’s even harder if you do it alone. The number of one-parent households is growing in the US, and most are led by single moms. As a result, women often face rising childcare costs while having limited finances.

There is no shame in asking for emergency help. Luckily, there are multiple resources, programs, and services that offer immediate assistance for single mothers when their finances run out. Here, we provide reliable, step-by-step instructions on how to access emergency cash quickly and avoid mistakes.

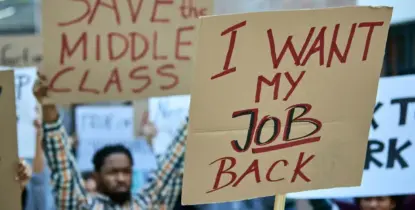

Why Emergency Cash Matters for Single Mothers Today

Single mothers often have the least financial backup. In 2022, 28% of single-mother families lived in poverty. That’s almost double the rate for single fathers and five times higher than for married couples. When a job gets cut or a bill shows up, the impact hits fast.

Every situation is different, but common emergencies single moms face are:

- rent that’s a week overdue

- a power bill with a shut-off notice

- a child’s medical or dental visit not covered by insurance

- a broken-down car that stops you from getting to work

- last-minute childcare or emergency purchases

Getting quick cash does more than cover one bill. It stops a small problem from turning into eviction, losing your car, or getting into long-term debt.

Government Programs That Cover Emergencies

Public programs protect basics – food, shelter, and heat – while parents get back on their feet. Here are the main ones:

- TANF cash or diversion check. Monthly cash or a one-time payment up to $2,000. States issue diversion help within a 30-day window each year.

- SNAP. Pays for groceries through an EBT card. Expedited households get benefits within seven days.

- WIC. Covers formula and healthy food for mothers and children under five. Many clinics offer benefits the same day as the appointment.

- Emergency Housing Voucher. Covers part of the monthly rent when you are at risk of eviction. Local housing agencies prioritize crisis cases.

- LIHEAP crisis grant. Provides assistance with past-due heating or electric bills. Cases must resolve within 48 hours, or 18 hours if it’s life-threatening.

One Place to Check for All of These Programs

Go to Benefits.gov to find the program that meets your situation. Use their tool to see what help you might qualify for. Then apply online or visit the local office listed. Bring your documents. That usually means a photo ID, proof of where you live, your income, and whatever bill or notice shows the emergency.

Where to Find Emergency Grants for Single Mothers

Grants beat loans because they create no new debt. They provide one-time assistance that you can use for any childcare-related expenses without the need to pay the money back. Yet, grants are often harder to get. Besides their strict eligibility criteria, they are also in high demand among single moms.

Active Grant Spots to Check First

- Kickass Single Mom Stimulus Grant – This grant provides $500 to one mom each month. You need to complete a ten-minute online form.

- Modest Needs Self-Sufficiency Grant – With its help, you can get $750–$1,250 to cover a single bill. Funds go straight to the vendor (landlord, mechanic, dentist).

- Children of Restaurant Employees (CORE) – The CORE grant covers rent, utilities, or childcare for food-service employees with children during illness or disaster.

- Union Plus Hardship Help – This grant provides one-time cash for eligible union households facing eviction or shut-offs.

- Community action agencies – CAAs are local nonprofits that offer a wide range of support services to help single mothers achieve self-sufficiency. This includes affordable housing, employment support, childcare assistance, and more. Look under “Community Action” + your county.

Beware the “Too-Good” Grant

Advance-fee requests or “guaranteed for everyone” approvals signal a scam. The Federal Trade Commission lists common warning signs on its site. Keep in mind that real grants:

- Never charge a “processing” or “application” fee

- Require clear paperwork before approval

- Publish a phone number and street address

How to Raise Emergency Funds Through Crowdfunding

Crowdfunding can turn a network of friends, co-workers, and even strangers into a rescue line. Here’s what you should do to get started:

- Choose a platform. Services like GoFundMe and Spotfund typically work best for single moms as they focus on personal and emergency needs and have user-friendly setups.

- Write a direct headline. Clearly state your problem and why you need help. For example, “Help repair Sara’s only car so she can keep working.”

- Explain the numbers. Provide the bill amount and the date it is due. People trust specifics.

- Post one clear photo. A relatable image earns clicks faster than text alone.

- Share three ways. Social media, group text, and email cover different age groups.

- Update every milestone. A short “We hit 40 percent – thank you!” keeps your page active in feeds.

Campaigns that state a deadline, attach receipts, and thank donors publicly often reach their goal in days. Vague or open-ended requests rarely gain traction.

Local Nonprofits and Charities Offering Emergency Aid

Often, the fastest help sits within a mile or two. Here are some organizations you can turn to for free support:

- United Way referrals may cover rent, utility help, food, transport, diapers, and low-cost clinics. Dial 211 or visit 211.org today. Provide your ZIP code to receive local referrals. Some United Way offices send payments directly to landlords or utility companies.

- Catholic Charities provide eviction prevention, baby supplies, and case management, no matter your faith.

- The Salvation Army offers financial, food, and childcare assistance, as well as emotional and social support.

Each branch sets its own rules. Call first, and bring your ID, proof of income, and a notice stating the date you need to be paid.

Extra Ways to Get Money Now Without a Loan

Short-term earnings and sales can close smaller gaps without future debt. Here are several money-making ideas.

Sell What You No Longer Use

Walk room to room and look for the items you don’t need, such as electronics, books, furniture, musical instruments, or kids’ clothes in good shape. Then, post clear photos on Facebook Marketplace or OfferUp. Agree on a public meeting spot, set cash or instant-pay only, and note “first come, first served” to avoid hold requests that never show.

Find a Part-Time Job

Sometimes, a temporary small job can be the only way to get emergency funds. Consider food delivery via Instacart, DoorDash, and Uber Eats to get paid weekly or even daily. Earn by completing various tasks through TaskRabbit or Thumbtack. If you can provide child or pet care, Care.com and Rover let you set your own rate.

Turn Skills Into Digital Cash

Create a Fiverr or Upwork profile offering proofreading, data entry, small graphic fixes, or social-media captions. Many clients offer same-day payouts via PayPal once the file is accepted.

Other Immediate Ideas

Here are a few more options you can consider:

- Plasma donation. Accredited centers pay around $50 per visit; you can donate twice a week if you are healthy.

- Recycle scrap or cans. Metal yards pay by weight, and bottle-deposit states make quick cash on cans.

- Return recent purchases. Receipts in hand turn unopened items back into dollars.

Mixing two or three tactics often brings in a few hundred dollars within a week.

Fast Emergency Loans for Single Moms With Bad Credit

When government programs, grants, charity, and income ideas fall short, a loan can stop an eviction or help you cover money gaps between paychecks. Just make sure the repayment fits your budget before applying and approach this option responsibly.

Here are the most common loan types available to single mothers with credit issues:

Payday loan

Payday loans allow you to get a small amount of cash, often on the same day. State law generally limits loans to $100 – $1,000. The average cost is about $15 per $100 borrowed. Repayment is usually due in 30 days.

Cash advance app

Cash advance apps allow you to get from $20 to $250 until your paycheck within a few hours. These apps often charge no interest but may take a small fee or a tip for their service. Be careful, as regular reliance on these apps can create a cycle of repeated borrowing.

Online installment loan

Installment loans range from $500 to $5,000 with funding in one to two business days. They carry fixed APRs that are usually lower than payday loan rates. Extended repayment terms result in lower monthly payments but can increase the total cost of the loan.

Credit union PAL

Credit union members can borrow $100 to $2,000 for a period of up to 6 or 12 months. While a hard credit check is needed, this option is still available to bad credit applicants. APR is limited to 28% under federal caps. Membership rules apply before you submit an application.

Be Mindful If You Decided to Get a Loan

Before you borrow, take a few minutes to read the full agreement. Make sure the terms are reasonable, and you fully understand them. If something is unclear, don’t ignore it – ask questions. Here’s what you need to pay special attention to:

- Repayment terms. Know your repayment schedule, frequency of payments, exact amounts due, and maturity dates.

- APR. An annual percentage rate (APR) reflects the total cost of borrowing over a year. Knowing it will help you understand the real cost of the loan.

- Extra costs. Pay attention to origination fees and extra charges that may occur under certain conditions.

- Requirements and documents. Lenders may have different eligibility criteria and credit score requirements, so make sure you meet them. Also, prepare your government-issued ID, recent pay stub, active checking account details, and proof of address.

- Your current financial situation. Make sure you have a good reason to obtain a loan and borrow only what you need to cover emergency costs. Always have a realistic repayment plan to avoid financial and credit problems down the road.

What to Avoid: Predatory Lenders & Scams

Emergency needs should not steer you into a deeper hole. Here arered flags you should avoid when choosing a reliable source of assistance:

- processing or application fees for grants

- upfront fees before a loan is approved

- “guaranteed for everyone” loans with no credit check

- triple-digit APRs with unclear or missing breakdowns

- repayment through gift cards or wire transfers

- no street address or only a P.O. box

- calls or texts that push “act now or lose the offer”

If you become a victim of scam or find an activity suspicious, report it to consumerfinance.gov or ftc.gov.

FAQ

Can hardship grants for single mothers pay a security deposit, or do they cover only overdue rent?

Some hardship grants for single mothers focus on eviction prevention, so they often pay past-due rent first. Yet, community action agencies and local housing funds may let you use the grant for a new security deposit if moving keeps the family safe. Ask the program officer before you submit papers; rules may vary by county.

Where can I get immediate assistance for single mothers after office hours?

Call 2-1-1 and ask for “after-hours emergency funds for single mothers.” Operators can connect you to churches that issue gas cards, motel vouchers, or small cash stipends at night. You can also text “HELLO” to 741741 for crisis navigation if the situation feels urgent.

Do hardship loans for single mothers need a co-signer?

Most lenders approve hardship loans for single mothers based on their income alone, with no co-signer required. A personal loan may ask for a co-applicant if your credit is low or debt-to-income ratio is high, but it is not typical for quick cash products.

What helps your online grant request stand out when so many single moms are applying?

Attach proof of hardship – an eviction notice, medical bill, or mechanic’s estimate – and a short budget that shows why the amount will solve the crisis. Grant reviewers like clear numbers.

Can I combine several single parent grants to cover one large bill?

Sure, you can apply for multiple grants if you meet the eligibility requirements. However, some organizations may have restrictions. List every grant you apply for on each application to build trust.

Is financial help for single moms taxable?

Not all financial aid for single moms is taxable. Child support, most welfare programs and need-based scholarships covering tuition, fees and books don’t count as income. If you’re unsure whether a payment is taxable, check the program rules or consult a tax specialist.

Are there loans for single mothers with no credit check?

“No credit check” loans are typically a trick and may be a signal of scam. Look for options that use a soft credit check instead: bad-credit installment loans offered online, payday loans, title loans, cash advance apps, and P2P loans. Soft credit check loans do not hurt your credit score and ensure a lender cares about your ability to repay.

Which programs help single mothers cover college costs?

Look at federal Pell Grants, state need-based scholarships, and single mother grants from organizations like Soroptimist Live Your Dream. These funds can help you with tuition, books, and childcare while you study.

Is there truly free money for single mothers to pay bills?

Among the options that offer free funds for single mothers are grants, crowdfunding, and charity support. However, you may be asked to meet certain criteria to qualify for some of them.

Can I request assistance for single mothers while receiving unemployment?

It depends. Unemployment benefits count as income, yet most programs base approval on total household earnings. Bring your benefit letter; some grants even view the benefit as proof you are job-seeking.

Will paying a single mom loan on time improve my credit?

Yes, but only if the lender reports to the major bureaus. In such a case, you will typically undergo a hard credit check as part of the underwriting process, which may temporarily drop your credit score by a few points. Ask before you sign.

Is the $7,500 single-mom grant real?

No verified national grant provides that amount to individuals. Treat any fee-based “application” for it as fraud.

Get emergency cash for moms online today!Apply