Charities We Support

At 1F Cash Advance, our vision extends far beyond just helping people find accessible financing. Since our launch in 2019, we have been committed to supporting communities we serve to achieve a brighter and more sustainable financial future together. We strongly believe that giving back is our way to contribute to improving the quality of Americans’ lives.

1F Cash Advance is pleased to help the foundations and organizations that offer charity and social betterment projects with a focus on healthcare, education, animal rescue, assistance to children and families in need, as well as the preservation of cultural and historical heritage and environmental improvement.

Our Events and Donations

Learn more about each charity and why we support it:

4 Paws 4 Life

This dedicated 501c3 nonprofit is an Animal Rescue & Boarding Facility located in Colorado. The organization is focused on making a positive impact on the lives of animals in need.

4 Colorado Kids

4 Colorado Kids was founded in June 2017 by a group of local business owners, teachers, therapists, parents and advocates. The program helps close the gap for local families and kids living in poverty.

Farmaste Animal Sanctuary Inc.

Verified by the Global Federation of Animal Sanctuaries, this organization rescues abused, neglected and unwanted farm animals and brings them to its 30-acre farm in Lindstrom, MN.

1% For The Planet Inc.

This global network consists of thousands of businesses and environmental organizations working together to support the planet. It offers businesses a simple solution to drive environmental impact and build credibility.

16WAYS Foundation

16Ways is a nonprofit organization under section 501(c)(3) that launches programs with a charitable contribution to change the lives of youth and families in Michigan, Kentucky, Georgia, Florida and Colorado.

Project Healthy Smile

Project Healthy Smile is focused on preventive dental care and health education. Since 2009, it has provided sustainable oral health programs for underprivileged children worldwide.

The Arizona Food Bank Network

While one in seven Arizonans struggles with hunger, this food bank network distributes emergency food to those who have no money for groceries. Each month it helps feed more than 700,000 food insecure people in all 15 counties in Arizona.

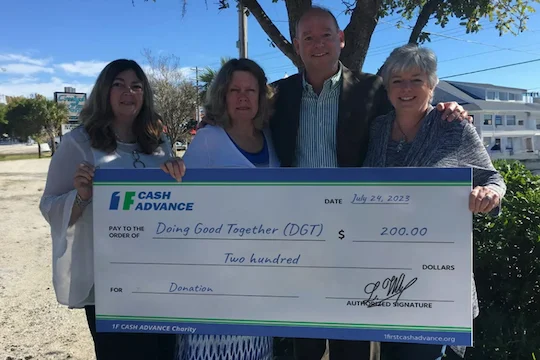

Doing Good Together™

Doing Good Together™ (DGT) is a Minnesota-based national nonprofit that empowers families to raise thoughtful, civic-minded children by offering opportunities for them to practice kindness and serve others.

Warriors & Quiet Waters

This purpose-driven veteran service organization uses nature-based experiences to restore a sense of community and belonging to post-9/11 combat veterans and their loved ones and help them reach guided personal growth designed to recover mind, body, and spirit.

Orphan’s Lifeline International

For the past 25 years, this organization has provided food, shelter, medical care, children’s Bibles, educational assistance, adoption advocacy, and other services to fatherless children in India, Pakistan, Uganda, Kenya, Philippines, Mexico, Russia, Haiti, and Liberia.

REACH OUT & CARE WHEELS INC

ROC Wheels empowers wheelchair recipients through its therapeutic, youth, and community programs to help them become more sustainable and reach their highest potential.

Books For Africa, Inc.

Books For Africa is the largest shipper of donated text and library books to the African continent. Since 1988, it has shipped over 59 million books to all 55 African countries.

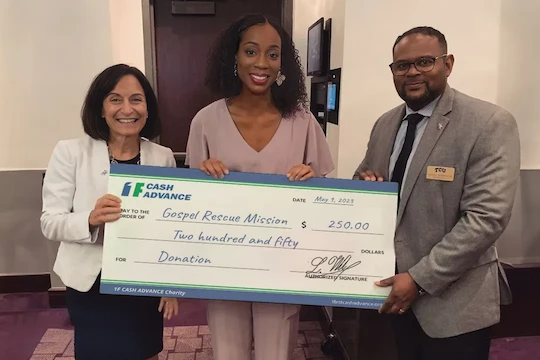

Gospel Rescue Mission

The Gospel Center Rescue Mission, Inc. is a San Joaquin County ministry that offers the homeless and addicted the opportunity for spiritual, physical, emotional, and social restoration through the love of Jesus Christ.

K9 Care Montana, Inc.

K9 Care Montana is an organization that provides the highest quality Service Dogs at no cost to Wounded Veterans, First Responders, and children challenged by Autism.

Boys to Men Tucson, Inc.

This training strengthens our communities by nurturing intentional spaces for boys, men, and masculine-identified individuals to practice honest and mindful relationships. It helps young people find consistent adults who show up, listen without judgment, and walk alongside them.

CDT Kids

CDT Kids believes in every child’s ability to learn and develop skills that will benefit their future. They provide educational, therapeutic, and adaptive recreational services to community children with exceptional needs.

Want Us to Donate?

At 1F Cash Advance, we support various projects that are designed to help our communities prosper and build a better and kinder future. Our donations are based on legal compliance, philanthropic efforts, alignment with corporate values, and evidence of financial health and social impact.

Here are the projects we considered for charitable contributions, sponsorships, volunteer support, or in-kind donations:

501(c)(3) nonprofit organizations

501(c)(4) social welfare organizations

501(c)(6) business leagues

Please note that we will not be able to consider requests in the following categories:

- Organizations that discriminate on the basis of age, sex, race, religion, national origin, sexual orientation, or disability.

- Organizations raising funds on behalf of other nonprofit entities.

- Religious organizations seeking support for sectarian activities.

- Requests to provide financial support to individuals, political candidates, or political campaigns.

- Pageants, athletic travel teams, or personal fundraisers for trips.

- Operating or administrative expenses of an organization or business.

- Organizations that present a conflict of interest to 1F Cash Advance.

Contact Us

Want to request a donation or have some questions left? We’re always here to assist! Please note that the request should be sent at least two weeks before the requested date.

Mailing Address

1F Cash Advance, LLC

1942 Broadway St.

Ste. 314C

Boulder, CO 80302

Phone: (720) 428-2247

Email: [email protected]

Hours

Monday-Friday: 8 am – 10 pm (MT)

Saturday: 9 am – 6 pm (MT)

Sunday: Closed