What Are Title Loans and Are They Worth Using in 2026?

14 Min Read

- What is a title loan?

- How to apply for a title Loan

- How much do title loans cost?

- Eligibility requirements

- Is there a credit check?

- Where are title loans legal in 2025?

- Risks to consider before taking out a title loan

- Title loans vs. other borrowing options

- Alternatives to title loans

- How to choose a safe lender

- The 1F Cash Advance perspective

- Frequently asked questions

Key Takeaways

- Car title loans are short-term financial solutions that use your vehicle as collateral.

- Lenders typically base approval on the vehicle’s value and the borrower’s financial situation.

- Such loans come with high APRs and carry serious risks of repossession.

- Many states heavily restrict title lending, imposing strict limits, tight regulations, or even outright bans.

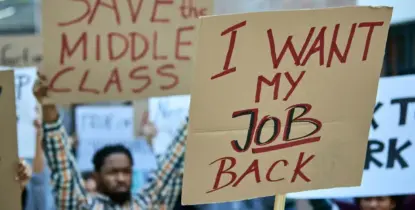

Title pawn or secured no-credit-check loan ads often promise fast cash, minimal paperwork, and instant decisions. While the speed can be tempting during a financial crunch, these offers carry high interest rates, strict regulations, and significant risks.

This guide explains what title loans are, how they work, the potential risks involved, and safer alternatives you can consider.

What Is a Title Loan?

It is a short-term loan secured by your car. The lender places a lien on the automobile, motorcycle, or RV while you continue to use the vehicle. Once you repay the amount in full, the lien is removed, and the title is returned.

You may also hear them called:

- Auto title loans

- Title pawn

- Motorcycle title loans

- Registration loan (in some states)

Unlike companies offering unsecured financial products, title lenders primarily pay attention to your vehicle’s value and condition, not credit history. This is one of the main reasons people with damaged credit often turn to this option. Because credit checks are often limited or skipped, many borrowers assume approval will be easier. However, it is not guaranteed. Legitimate companies still check an applicant’s income to ensure their ability to repay.

Even though loans against a car title work well for people with bad credit, they also come with trade-offs that many overlook. They carry very high interest rates, short repayment terms, and the risk of losing your vehicle if you default.

How to Apply for a Title Loan

Getting a title loan doesn’t involve complicated steps, but there are still important factors to consider. Here’s how the process works:

- Application and Assessment: You apply for a loan, and the lender evaluates your car’s condition and its resale value. This assessment can be done in person through a physical inspection or remotely using photos, mileage, and vehicle identification data.

- Loan Offer: Based on this evaluation, the lender offers a loan amount that typically ranges from 25% to 50% of the vehicle’s value. If you agree to the terms, you sign a contract outlining the repayment schedule, interest rate, APR, fees, and consequences for missed payments.

- Funds Transfer: Money is normally released very quickly, often the same day, through direct ACH deposit, a prepaid card, or cash at a storefront.

- Repayment: Most title loans are paid back in one lump sum within 14–30 days. Some states, however, allow repayment in fixed installments over several months.

How Much Do Title Loans Cost?

This type of borrowing is considered one of the most expensive short-term financing products. Their cost structure is expressed as monthly fees instead of a traditional annual percentage rate (APR). Most lenders charge 25% per month, which translates to an APR of nearly 300%. For example, a $1,500 title loan taken for 14 days could result in a total repayment of $1,672.60.

On top of the interest charges, there may be additional costs, such as origination fees, lien fees, late payment penalties, rollover fees, and even storage and repossession costs in case of a default. Since title loans are short-term by their nature, it may be quite difficult to return funds on time. Extending the loan or rolling it over can quickly increase the total cost, sometimes exceeding the original amount borrowed.

Eligibility Requirements

To qualify for a title loan, several simple requirements must be met. They typically include:

- Vehicle ownership: The car must be in the borrower’s name, and it must be fully paid off. If there is a lien, a title loan will be denied.

- Official registration : Registration needs to be valid and listed under the applicant’s name. This confirms that the car is a legal belonging and is cleared to be driven.

- Insurance coverage: Lenders typically require proof of active insurance. Since the car secures the loan, they need to know it’s covered in case of damage or loss.

- Vehicle photos: For online applications, borrowers may be asked to upload clear photos of the vehicle — exterior shots, interior details, the odometer reading, and the VIN. This helps the lender verify the car’s condition without an in-person inspection.

- Stable income: Applicants must prove they are able to pay back. Income may come from employment, self-employment, rent, or government benefits. The point is that it should be consistent and backed by recent bank statements.

- Age and legal status: The borrower must be at least 18 years old and have U.S. citizenship or permanent residence.

- Active bank account: Applicants need a bank account to get a loan and for repayments.

- Personal and contact information: A government-issued ID, an SSN, an active phone number, a working email address, and proof of address are required.

Is There a Credit Check?

Title lenders typically do not perform traditional hard credit checks and often pay little attention to FICO scores. Since the loan is secured by your vehicle, the lender’s main concern is the car’s value and condition.

However, the absence of a hard credit pull does not imply that there is no background assessment at all. Lenders may use alternative consumer databases to review borrowers’ prior payday or title loan activity, current short-term debts, or default patterns. These checks do not affect your credit score, but can affect the approval decision.

It’s important to note that while on-time payments are generally not reported to major credit bureaus, defaults or repossessions may be sent to collections. In that case, negative information could appear on your credit report and harm your credit score.

Where Are Title Loans Legal in 2025?

The legality of this type of short-term borrowing varies widely from state to state. Some allow it with few or no restrictions, others impose strict rate caps that limit profitability, and some ban the practice entirely. As a result, applicants’ options and risks can differ significantly by location.

States Allowing Title Loans

A smaller group of states still allows this borrowing option or similar car-title-secured products, in some cases without strict cost caps. These states include:

- Alabama

- Arizona

- Georgia

- Idaho

- Missouri

- Nevada

- New Mexico

- South Dakota

- Tennessee

- Texas

- Utah

Even in these states, terms depend on state laws that set restrictions on limits and fees. In many cases, lenders rely on legal workarounds by classifying these products as installment loans, open-end credit, or pawn-style transactions rather than traditional secured loans.

States With Restrictions or Bans

According to a recent Center for Responsible Lending report, title loans are banned in 33 states and the District of Columbia.

In some states, local governments enforce strict interest rate caps that make high-cost title lending financially unviable. These jurisdictions often classify loans with extremely high APRs as predatory and apply strong consumer protection measures.

Here are some examples of how authorities deal with such loans:

- Connecticut: Prohibited under state law.

- New Jersey: 30% interest rate limit.

- Massachusetts: 12% interest rate cap.

- Alaska: State interest caps leave little room for profitable title lending.

- North Carolina: Tight regulatory oversight.

- Maryland: Strict lender approval and compliance requirements.

Despite these regulations, some companies attempt to operate through legal loopholes. For this reason, borrowers should always confirm that a lender is properly licensed, compliant, and authorized to operate under state law. Don’t be misled by whatever an online advertisement promises.

Why Laws Vary

In the United States, consumer lending is primarily regulated at the state level. Each state sets its own usury limits, licensing standards, and enforcement rules for short-term financial products. All these regulations are shaped by political priorities, historical credit behavior patterns, economic conditions, and even broader consumer-protection ideologies.

States that allow high-interest title loans often claim that these products provide access to emergency cash for people who are denied by traditional banks. On the other hand, states that restrict or ban them typically point to high default rates, repeated rollovers, and frequent vehicle repossessions among vulnerable borrowers.

Risks to Consider Before Taking Out a Title Loan

The most significant risk is vehicle repossession. Since your car serves as collateral, missed payments can quickly lead to its loss, often without prior notice. Losing your automobile can disrupt employment, childcare, medical care, and daily mobility, creating far greater financial strain than the original loan amount.

Another major risk is the likelihood of repeated borrowing. Many people cannot repay the full amount within the initial term, forcing them to roll over the loan and accumulate additional interest and fees. This can trap borrowers in a long-term debt cycle while the original loan amount remains unchanged.

There is also a risk of vague contract terms and aggressive collection practices. Some agreements may include acceleration clauses (demanding full repayment in case of default) or GPS tracking, which borrowers might not fully understand when signing. If repayment problems arise, collection efforts can escalate quickly, adding stress to an already challenging financial situation.

Title Loans vs. Other Borrowing Options

Title loans stand out from other options because they rely on your vehicle as collateral, which changes both the cost and the level of risk. To see the differences more clearly, here’s a side-by-side comparison of different financial products:

| Type | Typical Borrowing Amount | Interest & Fees | Repayment Structure | Main Risk |

|---|---|---|---|---|

| Title Loans | $100–$10,000 (depending on vehicle value) | Very high APRs, added fees | Lump sum or short-term installments | Loss of vehicle if you can’t repay |

| Personal Loans | $1,000–$10,000 | 5.99%–35.99% and higher | Fixed monthly payments over 12–60 months | Harder approval for bad credit |

| Payday Loans | $100–$1,000 | $10–$30 per $100 borrowed | Full repayment on next payday | Bank account overdraft or debt cycle |

| Installment Loans | $500–$5,000 | Starts at 16% and may reach 200%, depending on the borrower’s profile | Monthly payments over 3–24 months | Higher long-term cost if repaid slowly |

Alternatives to Title Loans

There are several alternative ways to cover urgent needs without relying on high-cost financial products:

- Buy Now, Pay Later: BNPL is a great way to split the cost of a purchase into smaller, interest-free installments. This can be useful for essential items, such as a new laptop for work.

- Family or friends: Asking a close friend or family member for help is a good option that can provide funds without interest or fees.

- Selling unused personal items: Selling gear or furniture no one needs can bring fast cash with no need to borrow.

- Paycheck advance: Some employers offer early access to earned wages, helping workers manage their issues without financial pressure.

How to Choose a Safe Lender

A reliable lender must be fully licensed to operate in your state. Before accepting any loan, verify the company’s registration through your state’s financial regulatory authority. Licensing ensures that the company is subject to local consumer protection laws and enforcement actions.

Transparency is another essential indicator of safety. A legitimate creditor clearly discloses the full cost of the loan, together with APR, late fees, and repossession terms, before you sign any documents. If they avoid direct answers or don’t provide a written agreement from the start, take it as a serious warning sign.

Another important factor is how defaults or delays are handled. A responsible lender clearly explains what happens if repayment becomes difficult, whether extensions are available, and what additional fees may apply. They never pressure borrowers into repeated rollovers or exploit hidden contract clauses for extra profit.

Finally, secure data handling is critical. Personal and banking information should be protected through encrypted systems, and lenders should never demand access to unnecessary personal data as a condition of approval.

The 1F Cash Advance Perspective

At 1F Cash Advance, we believe fast cash solutions should never come at the cost of long-term financial stability. While vehicle title loans may offer quick funding, they expose borrowers to excessive interest and the real risk of losing essential transportation.

Our platform focuses on safer lending alternatives, including unsecured short-term loans and structured installment options with income-based approvals. We promote responsible borrowing, transparent pricing, and repayment plans designed to support — not trap — our customers.

If you are facing a short-term financial emergency, exploring alternatives to traditional title pawn products can help protect both income and mobility.

Frequently Asked Questions

Can I get a title loan without a job?

Yes, many lenders accept alternative sources of income, such as freelance work, disability benefits, or self-employment income. You still need to demonstrate a consistent ability to repay.

Can gig workers qualify for a title loan if their income is irregular?

Yes, gig workers can often qualify, as lenders may accept bank statements, 1099 forms, or platform earnings as proof of income. Learn more about cash advances for gig workers.

How fast can I get the money?

Funding may be processed the same day, but most loans are completed the next business day after approval.

Can I get a title loan if I’m still paying off my car?

Usually, such applications are rejected. Most lenders require you to own the vehicle outright or have substantial positive equity.

What happens to my car after repossession?

The lender may sell the vehicle to recover the debt. In some states, you may still owe a deficiency balance.

Do title loans affect your credit?

On-time payments are typically not reported to credit bureaus, but defaults and repossessions may appear on your credit report through collections.

Can I apply online today?

Yes. Most lenders allow online applications, though some still require in-person verification.

How many rollovers are allowed?

This depends on state law. Some states limit rollovers, while others allow unlimited renewals with added fees.

Can military members get title loans?

Yes, but active-duty service members are protected under the Military Lending Act, which limits APRs and restricts certain high-cost borrowing options.

Can lenders track or disable my car?

Some companies may install GPS tracking devices to monitor the vehicle. The ability to remotely disable a car varies by state and is subject to specific regulations.

How much can you get for a title loan?

The loan amount is determined after the automobile is evaluated, typically up to 50% of its market value.

What happens if I miss a due date?

First, late fees will apply, and continued non-payment may result in vehicle repossession.

Are online title loans safe?

Safety depends on licensing, transparency, and compliance. Many unlicensed lenders operate online, so verification is critical.

Explore flexible borrowing alternatives!Apply