Payday Loans in Los Angeles, CA

- Bad Credit Score Is Accepted

- Trustworthy Payday Lenders

- No Hard Credit Check

- No Collateral Is Required

- Easy Application Process

- Los Angeles Payday Loans Near Me

How to Get Payday Loans in Los Angeles, CA?

Welcome to 1F Cash Advance store – where you can get payday loans for emergency expenses. Check cashing services and money orders are also available. Can’t wait till your next payday to cover medical bills or car repairs? Don’t worry! Get Los Angeles payday loans by accessing our extensive network of payday lenders. Choose one of these methods to apply and get your money within one business day!

In-Store Application

Come to our office and fill in the application in several minutes.

Online Application

Apply online and request a payday loan in Los Angeles County from your home.

Apply by Phone

Find us at

(213) 566 3755

and apply through a call or get a link to the form via SMS.

1F Cash Advance Store in Los Angeles

Can’t find a suitable lender to get a payday loan? Rely on 1F Cash Advance! Visit us at our branch and get cash advances (Los Angeles) today! Our customer service agent will help you apply within minutes and get connected with a lot of lenders available in LA, California.

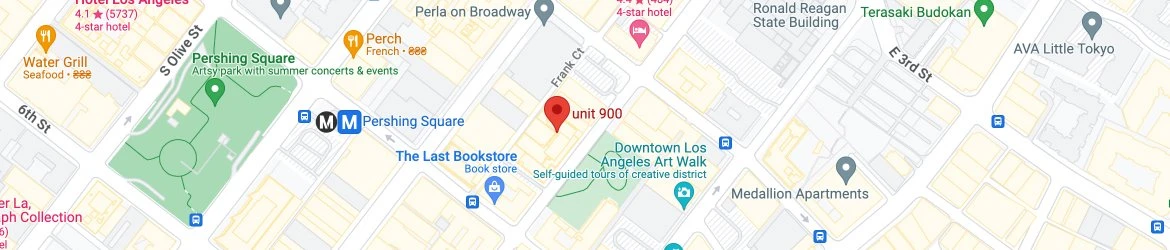

433 S. Spring St. unit 900, Los Angeles, CA 90013

Hours:

Monday – Friday: 8:00 am to 10:00 pm

Saturday: 9:00 am to 6:00 pm

Sunday: Closed

What Do We Offer

Online Payday Loans

Our lending partners offer quick payday loans (Los Angeles) with no high-interest rates. Get loan approval in several minutes and receive up to $300 as the maximum loan amount.

Small Personal Loans

A payday loan is not enough for you? Get a small personal loan from our direct lenders. Apply online for a small personal loan of up to $5,000 with flexible repayment terms.

Short-Term Loans for Bad Credit

Get a short-term cash loan with a bad credit score in your checking account today. You’ll receive an answer in 15 minutes from our lenders that allow all types of credit scores.

How Does It Work?

To get payday loans in Los Angeles, visit us at 433 S. Spring St., Unit 900, Los Angeles, CA 90013, and borrow money safely. It works straightforwardly. You complete the application form and give it to our branch manager. They send it to our payday lenders, who will review it and provide a loan decision.

Your payday loan will be deposited directly into your bank account if approved. You can spend it on whatever you need. You repay the payday loan on the due date or your next paycheck with no hidden fees.

Get a Payday Loan from a Direct Lender in Other Branches

Potential borrowers from other cities near Los Angeles can consider an online application that can be completed anywhere. Get payday loans in Los Angeles and not only. If you are from Anaheim, Irvine, Long Beach, Santa Monica, or Santa Barbara, apply for a payday advance, and we will connect you with a suitable payday lender.

Not in California? You can apply for a payday loan in Louisiana, Iowa, Arizona, Delaware, Oregon, Maine and Wyoming, or check out our locations in other states below!

Legal Status of Payday Loans in Los Angeles, California

In Los Angeles, as in the rest of California, payday lending is subject to certain legal restrictions and regulations. The state has implemented the California Deferred Deposit Transaction Law (CDDTL) to govern the payday lending industry. Under this law, payday lenders must obtain a license from the California Department of Business Oversight (DBO) to operate legally within the state.

The CDDTL sets specific guidelines regarding the terms and conditions of payday loans, aiming to protect consumers from predatory lending practices. For instance, the law limits the loan amount (up to $300) that can be borrowed and imposes caps on the fees and interest rates (the maximum APR is 369% on average in 2023) that lenders can charge. These provisions are in place to prevent borrowers from falling into a cycle of debt caused by an excessive interest rate and fees. The finance charges that payday lenders can request are $17.64 per $100.00 or 15% of the amount advanced (up to $45), plus a small setup fee. The maximum loan term is 31 days.

Note: from July 2020, payday lenders are not obliged to check your creditworthiness. This way, it’s the borrower’s responsibility to determine whether you can repay your potential debt. Keep in mind that payday loans should be taken seriously and used cautiously.

Your Benefits of Getting Payday Loans in Los Angeles, CA, through 1F Cash Advance

Are you considering applying for a loan from payday lenders and don’t know your advantages? Here is what you get when choosing to apply through us for payday loans in Los Angeles, CA:

- Transparency: We operate according to the lending laws of Los Angeles, CA, and we don’t charge any additional fees for our services. You’ll find a suitable payday lender within several clicks.

- Easy application process: You can apply in just minutes to request cash loans through 1F Cash Advance. Find a suitable payday lender in a convenient way!

- No hard credit check: Our lending partners don’t perform hard credit checks if you apply online in Los Angeles County. They verify your current financial situation.

- Quick access to money: You’ll receive your payday loan within one business day or sooner if you apply early in the morning.

- Bad credit is accepted: No need to have good credit to apply for cash in-store or online. Our lenders work with bad credit borrowers who need funds immediately.

Eligibility Requirements to Apply for a Payday Loan at a Los Angeles Store

When considering applying for a payday loan at a Los Angeles store, it is crucial to understand the eligibility requirements set forth by the lending institution. These requirements determine an applicant’s ability to repay the loan and ensure responsible lending practices. They may vary slightly between payday lenders. That’s why we suggest you research and confirm the specific criteria of your payday lender.

- An applicant must be at least 18 or older to be considered for a loan.

- The borrower must provide proof of a stable and verifiable source of income. This income requirement determines whether the individual can repay the loan amount borrowed within the specified terms. The minimum steady income is $1,000 per month, as proved by the bank statement.

- To qualify for a loan, potential borrowers must have an active checking or savings account.

- Applicants for payday loans at Los Angeles stores must present valid government-issued ID, such as a driver’s license or passport, to verify the applicant’s identity and ensure compliance with legal regulations.

To qualify for a payday loan, you need to reach the age of majority (18 years old), be a legal US citizen, and have a steady verifiable income. Alternative financial receipts, such as rent, alimony, or disability benefits, can also be accepted if you receive them regularly.

Frequently Asked Questions

Is a payday loan in Los Angeles a good option for me?

Yes, if you need to cover emergencies until your next paycheck, or not, if you feel that you can get trapped in the debt cycle. That’s why, before applying for a small payday loan online, assess your financial situation and see if you can repay it on time.

Do I need a bank account for a payday loan in Los Angeles?

Yes, you must have an active checking account. Most lenders will need it to transfer the money. They will automatically withdraw the cash advance loan amount from your bank account on the due date.

How many payday loans are allowed to have at once in Los Angeles?

You can get only one payday loan in your checking account in Los Angeles, CA.

How do I repay the payday loan in Los Angeles?

The payday lender will withdraw the payday advance amount and its costs from your active bank account on the due date or your next paycheck.

Do I risk jail time for not paying a payday loan in Los Angeles?

No, because criminal charges are prohibited in Los Angeles, CA. However, if you default on your loan, the lender will likely enlist the help of a collection agency to recover the unpaid loan amount.