Alternatives to Payday Loans in Arizona

- Borrow up to $5,000 today

- Quick and simple process

- Same-day funding available

- Apply online or in-store

1F Cash Advance has been providing emergency loans since 2019. We are licensed and operate under state laws. Over 140,305 consumers have already benefited from our services, both online and in stores.

Each our article is reviewed by leading industry experts and updated regularly. We ensure accuracy and currency through daily audits and automated updates. Learn more about our editorial standards.

With no payday loans allowed in AZ, installment loans become a fast and easy alternative you can turn to during an emergency. At 1F Cash Advance, we offer small personal loans at competitive interest rates to borrowers with bad credit.

Apply for an installment loan online by filling out our quick application form, receive an instant approval decision, and get the money from a direct lender on the same day.

Why Payday Loans Are No Longer Available in Arizona

Payday lending has been prohibited in Arizona since 2010 due to concerns over predatory practices. Prior to the ban, borrowers in the state could take out small loans of up to $500, often with an average APR of 459% for a 14-day term. That same year, the law that had previously exempted payday lenders from the state’s 36% annual interest rate cap expired. Since then, all state-authorized lenders must comply with the 36% APR limit.

Explore Your Alternatives

Borrowers who are looking for a legal alternative to online payday loans in Arizona can consider the following options.

Installment Loans

Installment loans from 1F Cash Advance are unsecured personal loans of up to $5,000 that are paid back over up to 24 months in scheduled installments. This flexibility makes them suitable for larger emergency expenses, big purchases, and debt consolidation. With us, you can get an installment loan within one business day, even with bad credit.

Personal Loans

A personal loan is a long-term financial solution that allows you to borrow up to $50,000, with a maximum repayment period of 60 months. Such loans are used to finance major purchases and big life events. Personal loan APRs usually range from 5.99% to 35.99%. Good credit is typically needed to qualify.

Credit Union Loans

Loans offered by credit unions often have lower interest rates compared to bank loans due to their not-for-profit nature. Federal CUs may offer payday alternative loans of up to $1,000 that need to be repaid within up to 6 months. These loans have interest rate caps of 28%. To qualify, you need to be a CU member and undergo a hard credit check.

How Do Installment Loans Work in Arizona?

1F Cash Advance installment loans in Arizona provide you with a lump-sum amount that you pay back in scheduled payments over up to 24 months. With us, you can borrow up to $5,000 with a fixed APR of 36% or less. We accept applicants with bad credit, so even those who were previously denied payday loans can qualify.

How to Get an Installment Loan?

We make the entire process fast and simple. Here are 3 steps to take:

-

Request a loan. Fill out our online form, visit our Arizona store, or call us at (888) 847-2909 to complete our 5-minute application.

-

Wait for approval. You will get a decision almost instantly due to no hard credit check involved in the underwriting process.

-

Get funded. Once approved, the money will be transferred to you on the same* or next business day.

*Same-day funding is possible for loans originated before 10:30 am on weekdays. Applications submitted after 10:30 am or on weekends will be processed on the next banking day.

What Do You Need to Apply?

The basic set of documents we ask for is as follows:

- Valid government-issued ID

- Social Security Number

- Proof of income

- Active bank account details

- Proof of Arizona address

- Valid email and cell phone number

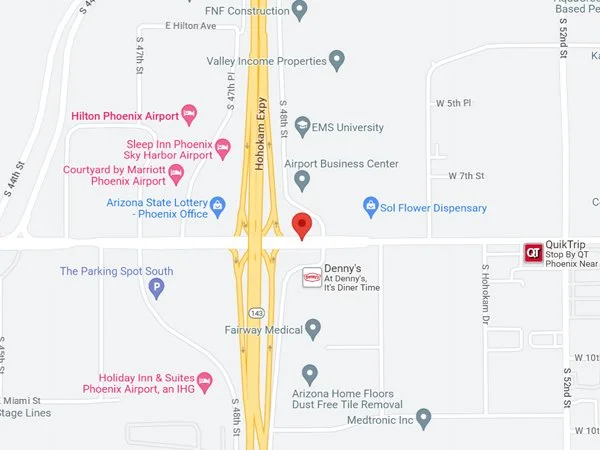

Find 1F Cash Advance in Arizona

We provide in-store assistance to borrowers who are looking for a personalized approach. Visit our Arizona location and let our team help you navigate the process.

Branch name: 1F Cash Advance Arizona

Address: 2604 W University Dr, Mesa, AZ 85213

Phone: (888) 847-2909

Email: [email protected]

Branch Manager: Tiller Martin

Hours:

Monday – Friday: 8:00 am to 10:00 pm

Saturday: 9:00 am to 6:00 pm

Sunday: Closed

Not in Arizona? We operate across the US. Find a 1F Cash Advance location near you.

Why Choose 1F Cash Advance

1F Cash Advance is a company that cares about the community it serves. We help bad credit borrowers get fast and reliable financial solutions at favorable terms. Here’s what we offer.

Easy & secure loan process

It will take you just a few minutes to complete our application form. We protect your data by using encryption protocols and don't share it with unaffiliated third parties.

Transparent terms

All the loan details will be clearly seated in your loan agreement and are easy to understand. There are no hidden fees or application charges.

Fast funding

You will receive your loan funds on the same or next business day of approval, depending on the time you finalize your loan.

FAQ

Are payday loans legal in Arizona?

No, payday loans are prohibited in Arizona. State law sets a 36% APR usury cap on all loans issued in the state.

Can I get a loan in Arizona with bad credit?

You're welcome. We assess your overall financial situation during the underwriting process, meaning that bad credit borrowers can still qualify.

What is the minimum and maximum amount I can borrow in Arizona?

1F Cash Advance offers installment loans between $500 and $5,000. The sum you can qualify for will depend on your income, credit standing, and the repayment period you choose.

Why do people use payday loans?

People usually turn to payday loans when they face unexpected expenses that need to be covered quickly. They are also popular with bad credit borrowers who can't qualify for traditional financing.