Payday Loans for People on Disability

7 Min Read

Getting a loan is relatively easy for many employed people, especially if you have a good credit history. However, the case is different if you’re receiving disability benefits from the federal government.

If you’re among the 8.2 million people that receive Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) issued by the Social Security Administration, you may be wondering whether you can get a payday loan. The short answer is yes.

If you’re considering applying for a disability loan, you need to know what lenders look at when evaluating a borrower’s eligibility and the factors to consider before taking such a step.

- Can I Get a Payday Loan on Disability?

- Can I Get a Payday Loan With a Direct Express Card?

- Can I Get a Payday Loan With an SSI Debit Card?

- Can I Get a Cash Advance On My SSI Check?

- What Lenders Look at When Considering You for a Payday Loan on Disability

- How to Increase Your Chances for Loan Approval?

- Things to Consider Before Taking Payday Loans on Disability

- Pros and Cons of Payday Loans on Disability

- Final Thoughts

Can I Get a Payday Loan on Disability?

It’s possible to get a payday loan if you’re receiving Social Security disability payments. But if this is your only source of disability income, you’ll likely have fewer lenders to choose from.

And if you find one, they typically charge high interest rates. This makes payday loans for Social Security disability quite expensive. This is especially true if you’re looking for payday loans for people on disability with bad credit.

For this reason, you should consider the interest rate you’ll be charged and work out your finances to see if you can manage to repay the loan on time.

Can I Get a Payday Loan With a Direct Express Card?

Some lenders offer disability payday loans online through a direct express card. But, not everyone receives their Social Security benefits in an active checking account.

Confirm with your payday lender to see if they accept payments via direct express card.

Can I Get a Payday Loan With an SSI Debit Card?

Yes, getting a payday loan with your SSI debit card is possible when receiving disability payments. Some lenders can place the borrowed amount directly into your SSI debit card. However, not all lenders offer this solution.

If you’re looking for disability loans for SSI recipients, ask your lender if they offer such an option.

Can I Get a Cash Advance On My SSI Check?

Some lenders offer cash advances based on social security benefits rather than traditional paychecks. This is because they treat such benefits as income. Other benefits that count as disability payments income in the eyes of lenders include:

- Disability living allowance;

- Personal independence payments (PIP);

- Employment and support allowance (ESA);

- Industrial injuries disablement benefit;

- Incapacity benefit.

The cash advance you can qualify for depends on your disability payments. The more your benefits, the higher amount of advance you may get.

The lender will then set up an automatic withdrawal from your checking account for payment.

What Lenders Look at When Considering You for a Payday Loan on Disability

As with any other loan, lenders look at various factors when evaluating your eligibility criteria for disability loans. They aren’t much concerned about whether you’re on disability or not but whether you can repay the loan.

Here are some of the things lenders look at when considering you for a payday loan on disability:

- Credit score: Lenders may perform a credit check on either of the three major credit bureaus or look at your credit report. They do this to see if you have a good history of repaying debts on time. If you do, you’re a less risky borrower.

- Income: Lenders may also want to see you have some type of income deposited into your bank account on a recurring basis. If you don’t make enough in SSI to cover the amount you want to borrow, you may not be approved for a payday loan online.

- Debt-to-income (DTI) ratio: Many lenders will also want to look at your financial history to determine the obligations you already have every month. If your DTI ratio is high, your chances of getting approved are low. The lower your DTI ratio, the better.

It’s important to note that such factors may vary based on the lender.

How to Increase Your Chances for Loan Approval?

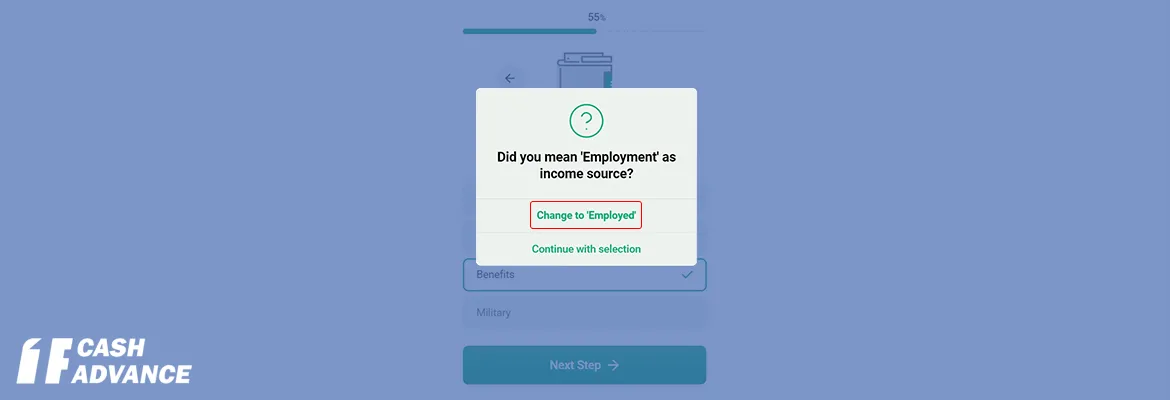

While on disability, you can increase your chances for approval with a single mark. How is that possible? When you fill out the loan application, make sure to check the mark with the answer “Change to ‘Employed’” at the question “Did you mean ‘Employment’ as an income source?” if you receive disability benefits or have part-time employment.

Even if your income is derived from disability benefits, selecting this option can help present a more favorable profile to the lender. Additionally, provide relevant documentation to support your employment status if you have a steady job or receive income from other sources. In the photo below, you can see how to do it right.

Things to Consider Before Taking Payday Loans on Disability

While taking payday loans with government assistance may sound like a great way to get quick access to cash, it may not be the best option for you.

Here are some of the things to keep in mind before taking the plunge:

- Requirements: Before applying for a disability loan, you want to know if you meet the lender’s requirements and are satisfied with the terms, interest rates, and repayment.

- Application process: Every payday loan lender has a different loan application process. Choose a lender that offers a seamless application with little paperwork. Online payday loans are typically easy to apply for.

- Repayment: When borrowing a loan, consider the repayment right from the start. Only borrow money you can repay with ease and on time.

- State laws: Payday loans for people on disability are much like cash advances. Such loans have strict regulations, and not every state allows them. Make sure you check your state’s laws regarding such types of loans.

Pros and Cons of Payday Loans on Disability

Like any other loan, disability payday loans have advantages and disadvantages. Weighing the pros and cons will help you make an informed decision.

Pros

- Easy to apply: Applying for disability loans is relatively easy, especially if you use an online lender. All you have to do is meet the requirements and fill out an online application form.

- Have fewer requirements than other loans: Unlike personal loans that may require lots of paperwork, payday loans on disability have fewer requirements. In most cases, you only need proof of income, credit score, and DTI ratio. These requirements vary by lender.

- Easy to access and get approved: As long as you meet the lender’s basic requirements, you can get approved for payday loans on disability in as little as one business day. Besides, the loan size is sometimes negotiable.

- It’s an unsecured loan: With a payday loan, you don’t have to provide any form of collateral. Even disabled borrowers with bad credit can get approved for a payday loan without security.

Cons

- High interest rates: One major downside of short-term loans is the high interest rates. This may cause the borrowing cost to spiral. You can find other loan options with better rates than guaranteed payday loans.

Final Thoughts

Expenses that come with disabilities can be pretty expensive. The good news is that you can qualify for a loan with bad credit and disability. Payday loans for disabled individuals can be a great financial solution. They can alleviate the financial stress that comes with being disabled. If you use the funds wisely, they can be a helpful resource and a great way to solve your money problems.

However, before submitting a loan request, evaluate your current financial situation to determine whether it’s worth it. Comparing lenders can also help you find the best deal, as such loans have incredibly high rates.

Ideally, you should choose a lender with the best rates, favourable terms and policies, and fast loan processing.

Before working with any direct lender, ensure that you have a loan agreement in place and is in writing. Review the terms and policies before signing the dotted line.

Get a Payday Loan for People on Disability NowApply